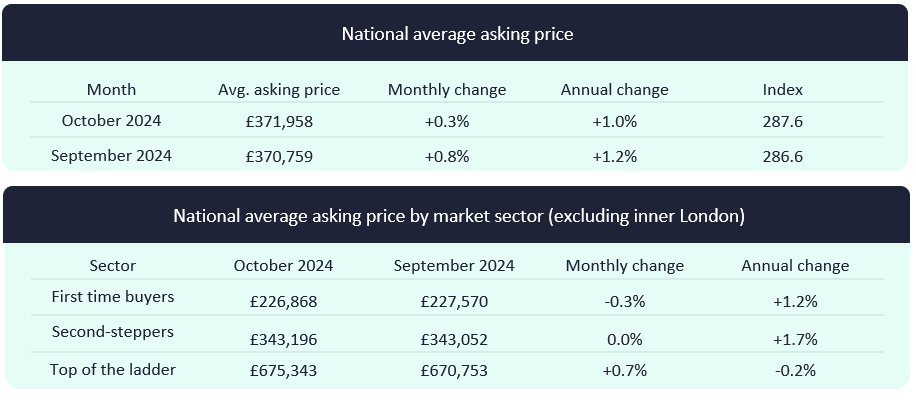

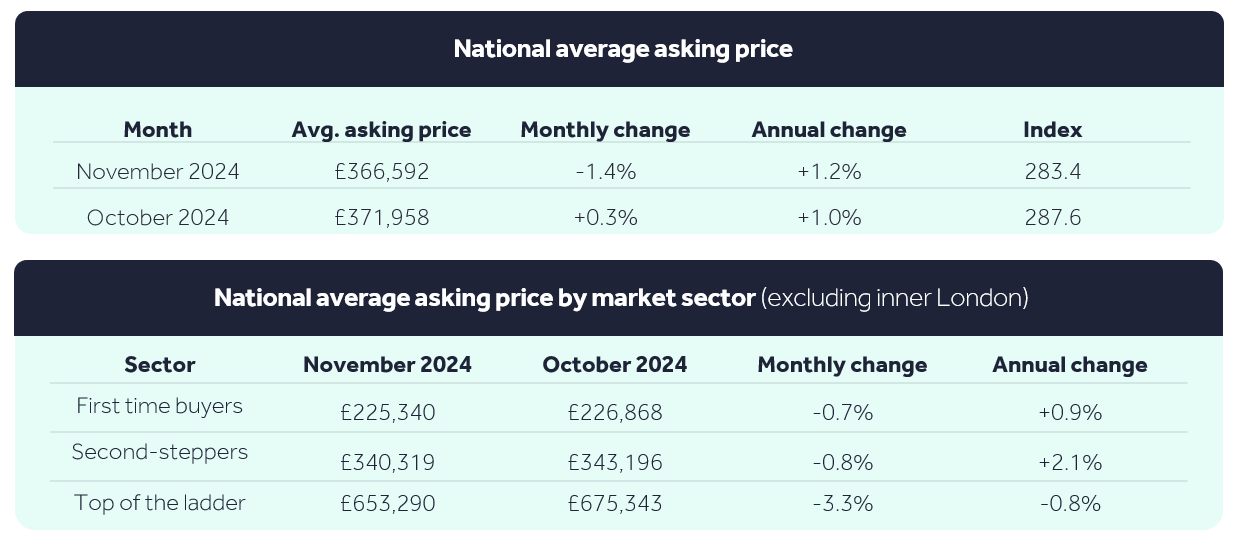

The November property market sees a 1.4% drop in the average asking price for new sellers according to the latest Rightmove House Price Index, equating to a £5,366 reduction, bringing the figure to £366,592. This decline exceeds the typical seasonal drop of 0.8% and reflects both pre- and post-Budget uncertainties. However, Bank Rate cuts have injected optimism into the market for 2025, even as the Budget pause temporarily dampens activity.

Key highlights

Asking Price Trends:

- The average new seller asking price fell 1.4% this month, marking the second consecutive month of larger-than-normal seasonal declines.

- This drop is attributed to reduced confidence following the Budget, with higher stamp duty charges affecting many home-movers, second-home buyers, and some first-time buyers.

Sales and New Listings:

- Sales agreed are up by 26% compared to the same period in 2023, showing resilience despite market challenges.

- The number of new sellers entering the market is also 6% higher than the same time last year, a sign of increasing market activity.

Impact of Bank Rate Cuts:

- Rightmove’s data highlights early signs of renewed buyer interest following the second Bank Rate cut.

- Buyer demand initially dropped from +23% to +18% after the Budget but has now returned to +23%.

- Seasonal slowdowns are still anticipated as Christmas approaches, but the overall outlook for 2025 remains positive.

2025 forecast: a stronger market expected

Rightmove predicts a 4% increase in average asking prices in 2025, the highest forecast since 2021. Lower mortgage rates are expected to unlock pent-up demand, applying modest upward pressure on prices. However, seller competition remains fierce, with the average number of homes per estate agent branch at its highest level for this time of year since 2014. Sellers will need to balance pricing strategy and presentation to attract affordability-stretched buyers.

Challenges for Sellers

- Price Sensitivity: Buyers continue to face affordability challenges, particularly with slower-paced Bank Rate cuts delaying significant mortgage relief.

- High Competition: The market is inundated with listings, making it critical for sellers to price competitively and offer well-presented homes to stand out.

Expert opinions

Tim Bannister, Director of Property Science at Rightmove, notes:

“The market is in a better place than last year, despite the Budget’s impact. Average asking prices are up 1.2% year-on-year, aligning with our 1% increase forecast for 2024. Looking ahead, 2025 shows promise as falling mortgage rates could drive affordability improvements, though sellers must remain pragmatic about pricing in a competitive market.”

Other experts suggest the current period offers a unique opportunity for buyers to negotiate, with flexibility likely to wane in January as activity surges post-Christmas.

Market outlook

Despite the short-term impact of the Budget, the November property market remains resilient, bolstered by optimism surrounding 2025. Lower mortgage rates, combined with sustained demand and strategic selling, are expected to shape a more positive landscape for both buyers and sellers in the year ahead.

Curious about your property’s value?

Find out today with a free online property valuation or call our team on 01634 570057.

Recent Articles