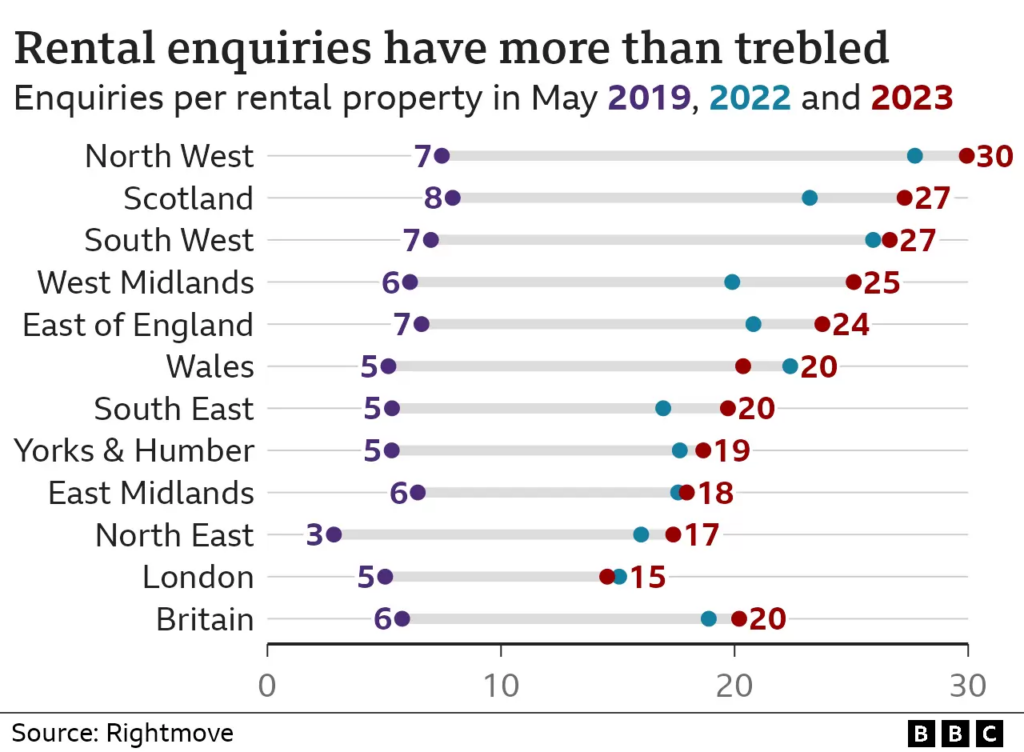

The surge in rental home demand has created an unprecedented situation where every home listed on the market experiences high demand. Consequently, landlords are faced with an elevated volume of rental applications to sift through in order to choose a suitable tenant. In this blog post, we will explore five effective strategies that landlords can use to speed up the tenant selection process. These tips will help increase the chances of finding the perfect tenant, and reduce the time and effort needed to do so.

Detailed property listings

Creating thorough property listings is one of the most important aspects when renting out your property. Dedicate some time to investigate the frequently asked questions about similar rental properties in Kent, and incorporate the responses into your property description. By proactively providing all the information upfront, including details like the number of bedrooms, available amenities, and proximity to local transportation options; you can assist potential tenants in assessing whether the property aligns with their requirements even before they express interest. This approach ensures that prospective tenants come prepared for viewings, saving valuable time for both parties involved.

Pre-qualify potential tenants

You can simplify the tenant selection process by pre-screening applicants. Prior to arranging viewings, request potential tenants to complete a pre-qualification form. This enables you to assess their eligibility for the property and understand their readiness to undergo reference checks.

This method reduces the risk of investing time in applicants who may not meet your criteria and allows you to focus your attention on those who have a genuine interest and a higher likelihood of successfully passing the reference checks.

Organise block viewings

Conducting separate viewings for every applicant can become a time-consuming and less efficient process, particularly when a property generates high interest. Instead, consider organising group viewings, wherein multiple prospective tenants are shown around the property in intervals of 10-15 minutes. This approach not only saves time for everyone but also creates a competitive atmosphere among applicants. Therefore encouraging them to make quicker decisions and submit their applications promptly.

Confirming attendance

Focus your efforts on confirmed viewings to reduce the likelihood of no-shows and to optimise your time. Prior to the scheduled viewing, send a reminder to the applicants and request their confirmation of attendance. By taking this approach, you can diminish the chances of last-minute cancellations and ensure that you are making the most efficient use of your time during each viewing.

Prepare your tenants for check-in

After you’ve narrowed down your pool of prospective tenants, assist your selected applicants in preparing for the next phase of the rental process by offering them detailed guidance, such as a step-by-step guide. This will help them grasp the requirements for a seamless check-in. This proactive approach not only minimises the need for extensive back-and-forth communication, but also demonstrates your dedication to delivering a positive rental experience.

Want to discuss your property?

We understand that as a landlord the surge in tenant demand can present opportunities and potential difficulties. If you’re feeling daunted by the prospect of securing a new tenant or if you’re interested in learning more about our comprehensive property management solutions in Kent, don’t hesitate to reach out to us by calling 01634 570057 or submit an online enquiry to our lettings experts.

Recent Articles