If you’re considering selling your home in Gillingham, selecting the right estate agent can make all the difference. With a trusted partner, you can navigate the market confidently, secure the best value, and enjoy a seamless selling experience. CR Real Estate, known as the best estate agent in Gillingham, is committed to delivering unparalleled service, expert insights, and a dedication to each of our clients. Here’s why CR Real Estate should be your first choice.

Unmatched local expertise in Gillingham

One of the most important benefits of working with CR Real Estate is our wide knowledge of Gillingham and the surrounding areas. We have been actively involved in the local property market for years. Which has given us insights into each neighbourhood, from Rainham to Twydall, Hempstead to Wigmore. This local expertise allows us to not only price your property accurately. But also connect with the right buyers who are looking for a home like yours in Gillingham.

A tailored marketing strategy for your home

To be the best estate agent in Gillingham, CR Real Estate goes above and beyond to ensure your property stands out in a competitive market. Our marketing strategies are carefully crafted for each property and include high-quality professional photos, engaging property descriptions, and listings on all the major property portals. We utilise social media, email marketing, and even local advertising to make sure your property receives maximum exposure. This multi-channel approach ensures that your property is seen by as many potential buyers as possible, speeding up the sale process and achieving the best price.

A personalised and client-first approach

At CR Real Estate, we understand that every property sale is unique, and every client has different needs. We take the time to understand your goals, answer your questions, and keep you informed throughout the selling process. From the initial valuation to negotiations and the final sale, our team is with you every step of the way. Providing guidance and ensuring you’re comfortable with every decision. This commitment to a personalised approach has earned us a reputation as the best estate agent in Gillingham.

Highly experienced and qualified team

Our team at CR Real Estate is made up of experienced professionals who bring a wealth of industry knowledge. We stay up to date on market trends, legal requirements, and best practices. Ensuring that you receive accurate advice and exceptional service. Our team is trained to handle all aspects of the selling process, including negotiations, viewings, and paperwork, so you can rest assured that your property sale is in capable hands.

Transparent communication and honest valuations

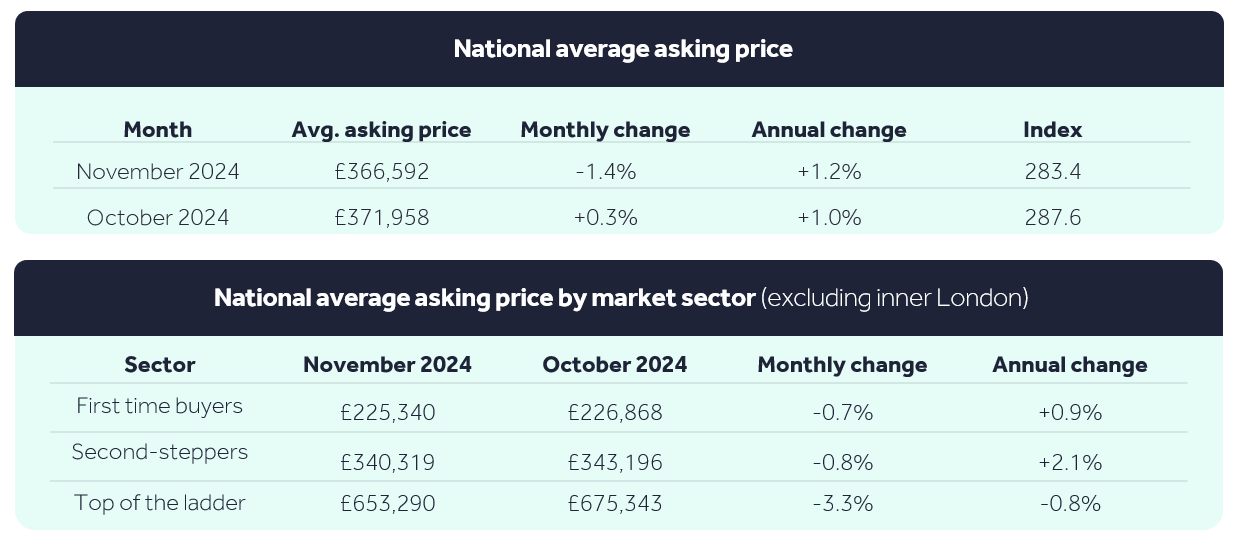

One of the biggest challenges when selling a home is understanding how much it’s worth. At CR Real Estate, we pride ourselves on offering honest, data-backed valuations. We provide a thorough market analysis, explaining every aspect of the valuation so you know exactly what to expect. Moreover, we keep you updated with regular market insights and provide honest feedback after each viewing. This level of transparency not only builds trust. But also ensures that your expectations align with the realities of the current market.

A proven track record of success

As the best estate agent in Gillingham, CR Real Estate has a proven record of helping homeowners achieve outstanding results. Our client testimonials and successful sales speak for themselves. We are dedicated to delivering results that not only meet but exceed expectations. Whether you’re looking for a quick sale or the highest possible price, we have the experience and drive to make it happen.

Choosing CR Real Estate: your trusted partner in Gillingham

Selling a property is one of the biggest financial decisions most people will make, and having a partner who understands the local market, prioritises your needs, and delivers results can make all the difference. At CR Real Estate, we strive to offer the best estate agent experience in Gillingham. We put our clients first, using our local expertise, and providing a personalised, results-driven service.

If you’re ready to sell your home in Gillingham, trust the best estate agent in Gillingham. Book a valuation online today for a free, and let us show you how we can make your property sale stress-free.