According to research, UK rental yields have experienced a slight increase in the past year, despite the housing market’s volatile nature. The research analysed house prices, rent values, and yields in June 2022 and June 2023 to understand the impact of the economic environment on buy-to-let investment returns.

What are the average rental yields in the UK?

Despite the challenging period in the UK with rising mortgage rates, there is an opportunity for proactive investors due to lower house prices and increasing rent values. The latest data shows that the average yield in the UK currently stands at 5.2%, marking a 0.4% increase compared to the previous year.

Among the regions, Scotland offers the strongest yields at 5.9%, making it an attractive place for investment. Other regional hotspots include Northern Ireland (5.7%), the North West (5.5%), Yorkshire & Humber (4.9%), and London (4.7%). Scotland also leads in terms of annual yield increases, showing a rise of 0.64%. Several other regions are performing well in terms of yield growth, with London at 0.49%, Wales at 0.35%, the West Midlands at 0.34%, the North West at 0.34%, and Yorkshire & Humber at 0.34%.

The battle for a place to rent

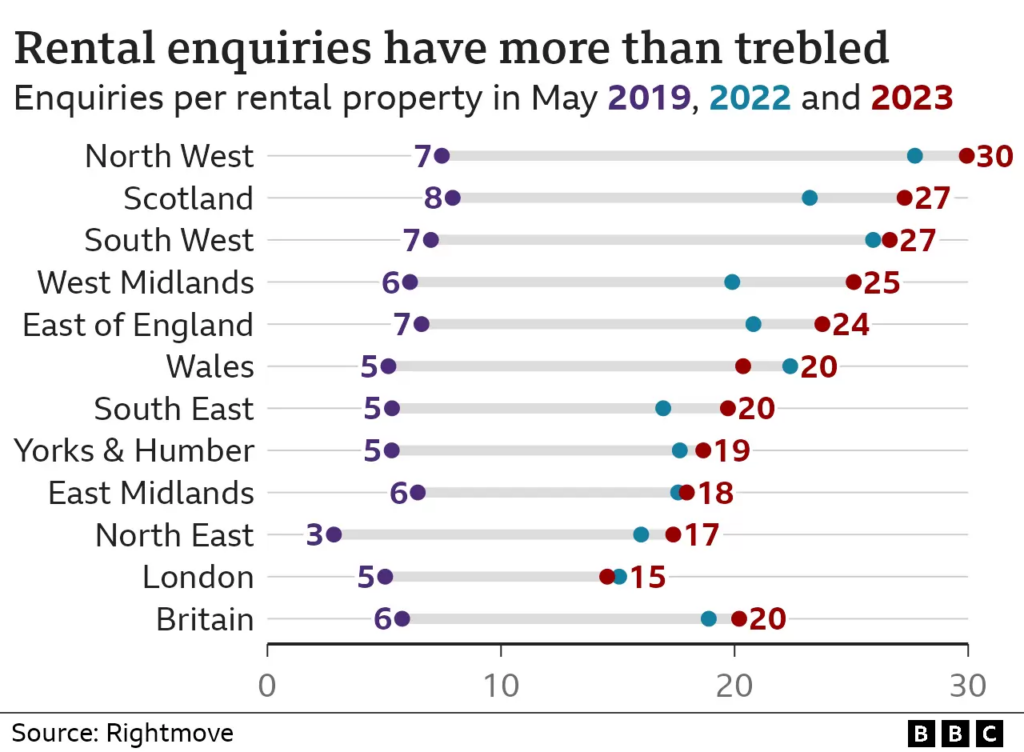

Data commissioned by the BBC reveals that competition among renters has intensified significantly, with 20 requests to view each available property. The average number of requests to see a home has more than tripled from six in 2019, according to figures from property portal Rightmove.

Additional research shows that tenants are reportedly making offers higher than the asking rent or even arriving earlier to secure a spot at the front of the queue. From our experience we are seeing that properties are getting rented out after the initial block of viewings due to the exceptionally high demand.

Lettings Manager, Sue Barnes suggests that the market presents opportunities for investors willing to take calculated risks, and the current UK environment exemplifies this. Despite economic struggles and concerns over rising mortgage rates, buy-to-let landlords with the means to handle current mortgage deals should consider seizing opportunities when suitable properties come to market in favourable locations. She emphasises that investors should take advantage of these moments when others may be hesitant.

Looking to invest?

We have a broad selection of ideal buy-to-let investment properties available, contact our expert team today to discuss this opportunity and how we can help you.

Recent Articles