October property market update

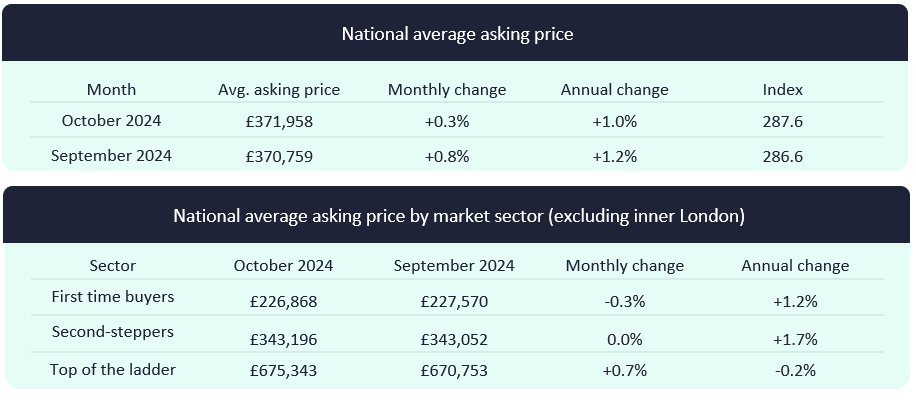

This October, the average asking price for new sellers increased by a modest 0.3% (+£1,199) according to the latest Rightmove House Price Index, bringing the average price to £371,958. This rise is notably lower than the usual seasonal 1.3% increase seen in previous years, highlighting a more subdued Autumn price growth. Despite this, market activity remains strong, largely driven by an increase in buyer choice and heightened competition among sellers. In Kent, the average asking price now stands at £424,375, with annual stock levels rising by 12.7%.

Sales have surged by 29% compared to the same time last year, showing a robust recovery from the weaker market of 2023. Buyer demand continues to rise, with 17% more people contacting agents about homes for sale compared to last October. However, the number of homes available for sale is also 12% higher than last year, with stock levels per estate agent at their highest since 2014. This increased inventory is giving buyers more negotiating power, putting downward pressure on price growth.

Mortgages

Affordability remains a key issue, especially with the average 5-year fixed mortgage rate now at 4.61%, a slight increase from last week’s 4.55%. Energy costs are also rising, with the average annual bill for homes rated with an Energy Performance Certificate (EPC) of D now at £2,465, up 10% since September. These factors may be causing some buyers to wait for more clarity from the Autumn Budget and potentially cheaper mortgage rates before committing.

Looking ahead, the financial markets predict two Bank Rate cuts before the end of the year, which could further improve affordability. Combined with wage growth outpacing house price growth, the outlook for 2025 remains optimistic.

With more properties on the market and stretched affordability, sellers need to price competitively to attract buyers. Despite this, strong market activity persists, with many buyers moving ahead with their plans while waiting for further economic clarity and mortgage rate reductions.

Expert opinions

Tim Bannister, Rightmove’s Director of Property Science, says:

“This month’s modest price growth reflects the increased choice for buyers, with sellers needing to price competitively in a market where affordability remains tight. We’re seeing strong sales activity, but some movers may be waiting for more certainty from the Autumn Budget and potential mortgage rate cuts.”

As we approach the end of the year, all eyes are on the Autumn Budget and its potential impact on the property market, with hopes that affordability will improve further heading into 2025.

Curious about your property’s value?

Find out today with a free online property valuation or call our team on 01634 570057.

Recent Articles