August property market update

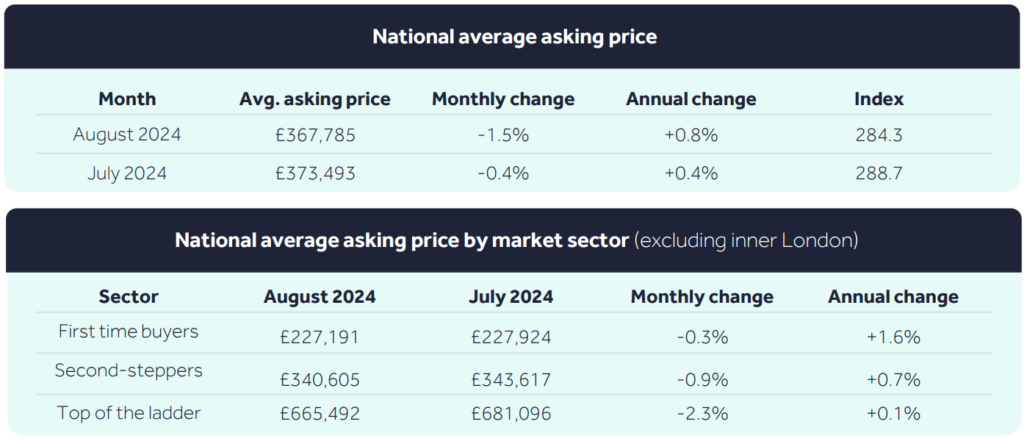

The average asking price for properties entering the market has seen a typical seasonal decline this month, dropping by 1.5% (-£5,708) to £367,785. For the past 18 years, August has consistently witnessed a dip in asking prices, and this year’s decrease aligns with the long-term trend. The summer holiday period often distracts buyers, causing them to delay moving plans, which in turn leads some sellers to price more competitively, especially if they need to sell quickly. However, unlike last summer’s peak-mortgage-rate market, this year’s sellers might benefit from renewed buyer interest.

As noted in our July update, the recent Bank of England rate cut—the first in four years—has accelerated mortgage rate reductions, boosting buyer demand and setting the stage for a promising autumn market. As a result, Rightmove have adjusted their 2024 forecast, now expecting a 1% increase in new seller asking prices instead of the previously anticipated 1% decline.

Tim Bannister, Rightmove’s Director of Property Science, says:

“The recent Bank Rate cut, the first since 2020, has sparked a late summer surge in buyer activity. While mortgage rates haven’t dropped significantly yet, the fact that the long-awaited rate cut has finally arrived, with rates trending downwards, is encouraging for those looking to move. As summer ends, the conditions are favorable for a more active autumn market. This positive response from home-movers, coupled with other encouraging trends, has led us to revise our 2024 forecast. We now predict a slight 1% rise in new seller prices over the year, a modest change from our original 1% decrease forecast, which had anticipated only a minor decline in prices.”

What’s happened since the rate cut?

Since the Bank Rate cut on August 1st, the number of potential buyers contacting estate agents has increased by 19% compared to the same period last year. This is a significant improvement over the subdued market of 2023, which nationally struggled with high inflation and peak mortgage rates. The rise in buyer demand, which was up 11% in July, highlights the immediate and significant impact of the Bank Rate cut.

What about house prices?

This positive shift, combined with other favourable market data, has prompted Rightmove to revise its end-of-year forecast upward, now expecting a 1% rise in new seller asking prices for 2024, instead of the previously predicted 1% decline. The market is likely to see small price increases in autumn, followed by the usual seasonal decreases at year’s end. While uncertainties remain—such as the October Budget, the timing of a second rate cut — the outlook for the rest of the year appears positive. Sales agreements between buyers and sellers are up 16% from last year, and the number of new sellers entering the market is 5% higher than this time last year.

Mortgages

Mortgage rates have also been declining, with the average five-year fixed rate now at 4.80%, a noticeable improvement from 5.82% in 2023, though still high compared to three years ago. Rightmove’s weekly mortgage tracker shows that the best available five-year fixed rate is currently 3.83% for buyers with a 40% deposit, the lowest rate since the period before the mini-Budget in September 2022.

While it may take a few more Bank Rate cuts for home-movers to see a significant reduction in mortgage rates, the immediate boost in buyer sentiment is clear. Both buyers and sellers are more optimistic, as shown by the recent increase in activity.

Curious about your property’s value?

Find out with our free online property valuation.

Recent Articles